What’s the most popular LLM? What the latest data shows

Last Updated:

Jan 5, 2026

Brief Article Overview

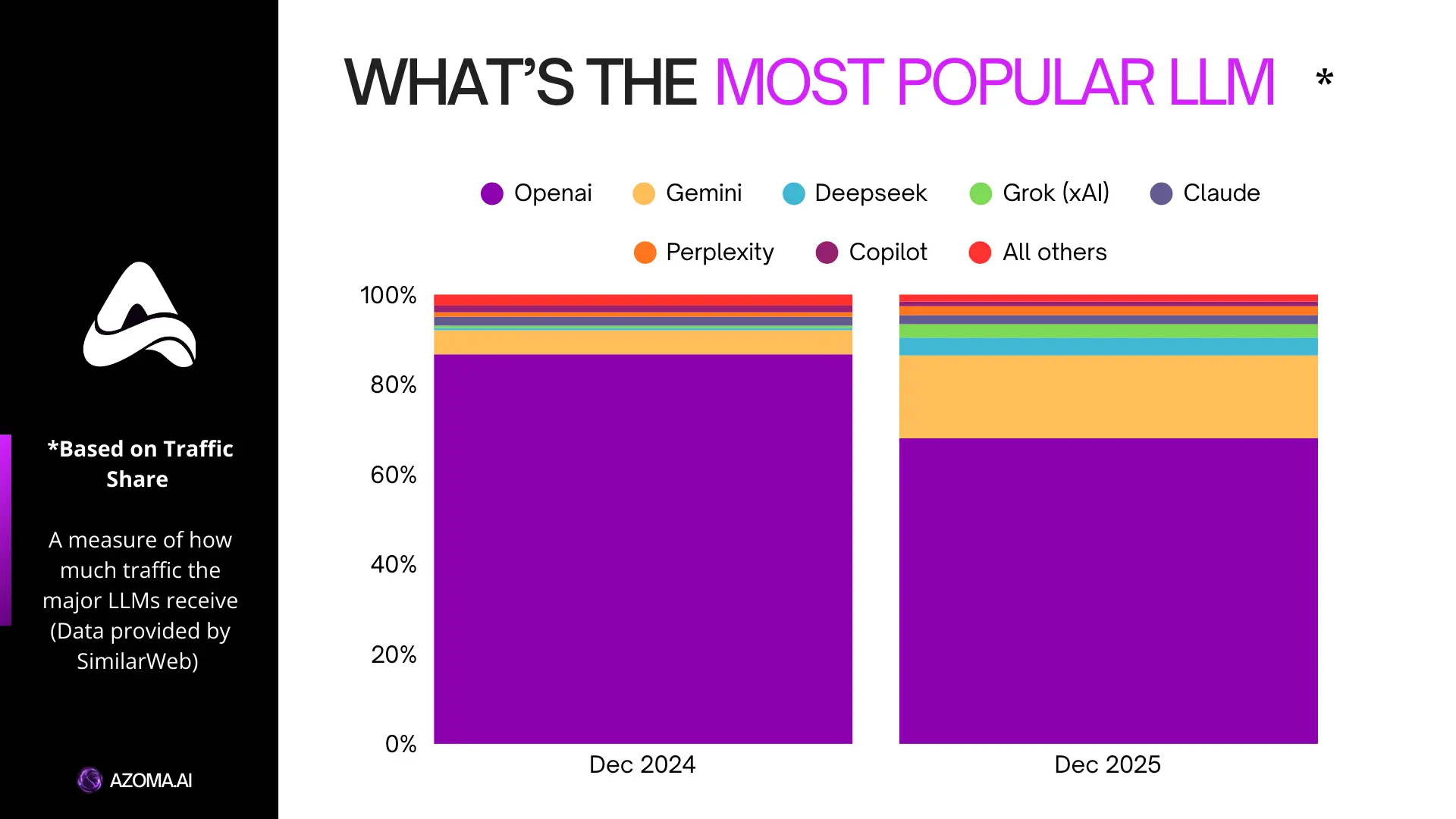

ChatGPT remains the clear market leader, but its share has fallen from ~87% to ~68% as new demand increasingly goes to competitors rather than defaulting to OpenAI.

Google’s Gemini is the clear second player, tripling its share to ~18% by leveraging distribution across Search, Workspace, Android, and Chrome.

DeepSeek’s rise has plateaued around ~4%, suggesting curiosity-driven adoption has limits without sustained trust and distribution.

Grok continues a steady climb to ~3%, driven by integration with X/Twitter.

Claude, Perplexity, and Copilot remain stuck in low single digits, highlighting how hard it is to break established defaults.

The market is shifting from winner-takes-most to a more fragmented, competitive landscape where distribution matters as much as model quality.

The Generative AI Market Is Fragmenting Faster Than Expected

For most of the past year, the consumer AI narrative has been simple: ChatGPT dominates, everyone else trails far behind. The latest traffic data from Similarweb complicates that picture.

Over the last 12 months, ChatGPT’s share of generative AI traffic has fallen sharply, from roughly 87% to 68%. Over the same period, Google’s Gemini has more than tripled its share, rising from just over 5% to more than 18%. Smaller players continue to grow at the margins, while several well-funded challengers remain stuck in low single digits.

The result is not a collapse of ChatGPT’s position, but a clear signal that the market is fragmenting faster than many expected.

ChatGPT Is Still Growing, But Its Share Is Eroding

At first glance, a 19-point drop in traffic share looks dramatic. In isolation, it might suggest users are abandoning ChatGPT. That is not what is happening.

ChatGPT now reportedly serves around 900 million weekly users, meaning its absolute usage continues to grow. The decline in share reflects something subtler: new demand is increasingly flowing to competitors rather than defaulting to OpenAI.

This distinction matters. ChatGPT is not losing relevance; it is losing exclusivity. As AI chat becomes a standard consumer behaviour, users are spreading activity across multiple tools rather than committing to a single interface.

In mature consumer markets, this kind of shift is often an early sign of category normalisation.

Traffic Share by LLM (Dec 2024 vs Dec 2025)

Model / Platform | Traffic Share (December 2024) | Traffic Share (December 2025) | Change (pp) |

|---|---|---|---|

ChatGPT (OpenAI) | 87.2% | 68.0% | −19.2 |

Gemini (Google) | 5.4% | 18.2% | +12.8 |

DeepSeek | <1% | ~4.0% | +3.0–4.0 |

Grok (xAI) | <1% | 2.9% | +2.0–2.9 |

Claude | ~1.5% | 2.0% | +0.5 |

Perplexity | ~1.0% | 2.1% | +1.1 |

Copilot | ~1.5% | 1.2% | −0.3 |

All others | ~3.4% | ~1.6% | −1.8 |

Gemini’s Rise Validates Google’s Distribution Advantage

The standout mover in the data is Gemini. Growing from approximately 5.4% to 18.2% in a year represents a 3.4× increase in traffic share, making Google the clear second player in the market.

This growth is unlikely to be driven by product quality alone. Instead, it reflects Google’s core strategic advantage: distribution.

Gemini is embedded across Search, Workspace, Chrome, Android, and now hardware. Users encounter it in contexts where they are already working, searching, or writing. That reduces the friction required to try, and then keep using, a new AI assistant.

Rather than pulling users away from ChatGPT, Google appears to be capturing incremental usage that would otherwise never have reached OpenAI in the first place.

DeepSeek’s Spike Highlights the Curiosity Ceiling

DeepSeek provides a useful counterpoint. The Chinese model surged to around 5.3% of traffic six months ago, before settling back to roughly 4%.

This pattern is familiar in AI markets. Novelty and performance gains can drive rapid experimentation, but sustaining Western consumer adoption requires trust, clarity on data handling, and integration into everyday workflows. Geopolitical concerns and limited distribution likely capped DeepSeek’s longer-term growth outside its core markets.

The plateau suggests curiosity alone is not enough to build durable share.

Grok Shows What Platform Integration Can Do

Grok’s rise has been quieter but more consistent. From near zero a year ago, xAI’s chatbot now commands just under 3% of traffic.

That number is small in absolute terms, but meaningful given Grok’s limited standalone presence. Its growth appears closely tied to integration with X (formerly Twitter) and repeated promotion by Elon Musk.

The lesson is similar to Gemini’s, albeit on a smaller scale: embedded distribution matters more than raw model capability when it comes to consumer adoption.

The Long Tail Remains Stubbornly Small

Perhaps the most revealing aspect of the data is who is not breaking out.

Claude, Perplexity, and Copilot all remain clustered between 1% and 2% of traffic share, despite strong technical reputations, significant funding, and positive press. Together, they illustrate how hard it is to capture consumer mindshare once a few default tools are established.

In practice, most users appear willing to experiment with a second or third assistant, but far fewer adopt a fourth or fifth. That creates a steep drop-off beyond the top two players.

Why Monetisation Pressure Is Rising for OpenAI

This traffic shift also helps explain OpenAI’s increasing focus on monetisation and advertising.

With an estimated 95% of users on free tiers, OpenAI’s challenge is no longer growth at all costs. As share declines, extracting more value from an already massive user base becomes more urgent. Advertising, partnerships, and commerce integrations are logical responses to a market where dominance is no longer expanding automatically.

At the same time, Gemini’s rise helps explain Google’s confidence in public messaging around AI disruption. Rather than losing ground to AI assistants, Google is successfully internalising the shift and retaining user attention within its own ecosystem.

A Market Entering Its Competitive Phase

Taken together, the data points to a generative AI market that is moving out of its winner-takes-most phase and into a more competitive, segmented one.

ChatGPT remains the category leader by a wide margin. But leadership now coexists with credible alternatives, each anchored by distribution rather than purely by model quality. As AI assistants become infrastructure rather than novelty, market share will increasingly reflect where these tools live, not just how smart they are.

For companies building, marketing, or selling through AI, the implication is clear: visibility across multiple models matters. The era of optimising for a single dominant interface is already coming to an end. If optimising for visibility across AI models is a priority for your business in 2026, reach out to Azoma today and explore how you can increase your share of voice across all major LLMs.

Article Author: Max Sinclair